What is the list of templates of accounting documents for small and medium enterprises in Vietnam?

What is the list of templates of accounting documents for small and medium enterprises in Vietnam?

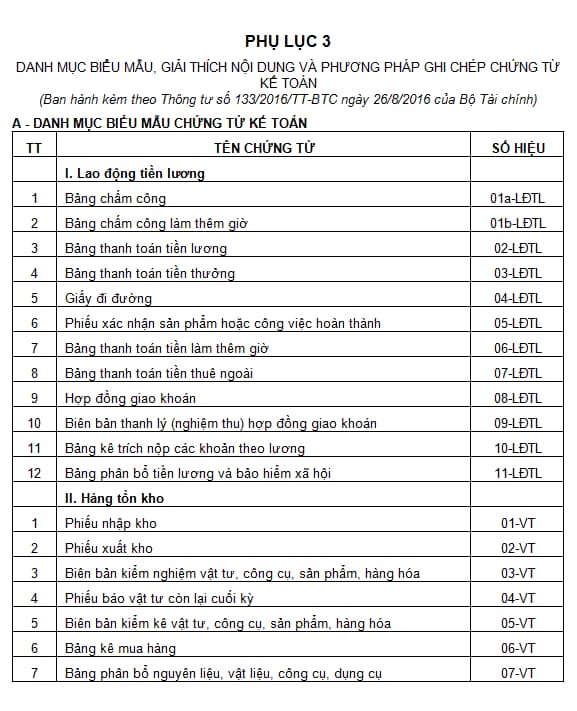

The latest templates of accounting documents for small and medium enterprises is specified in Appendix 3 issued together with Circular No. 133/2016/TT-BTC, specifically as follows:

See the entire system of templates of accounting documents: Click here.

What is the list of templates of accounting documents for small and medium enterprises in Vietnam?

What principles should small and medium enterprises prepare and sign accounting documents in Vietnam?

Pursuant to Article 85 of Circular No. 133/2016/TT-BTC, small and medium enterprises that prepare and sign accounting documents in Vietnam need to ensure compliance with the following principles:

- Business and financial transactions related to the enterprise’s operation must be recorded into accounting documents. Only one accounting document shall be prepared for each transaction.

- Accounting documents must be clear, timely, accurate and conformable with templates. An accounting unit may design accounting documents without templates as long as they are conformable with provisions of the Law on Accounting.

- Abbreviations, erasures and adjustments are not allowed on accounting documents; Accounting documents must be written with pens; numbers and text must be written continuously without interruption; blank spaces must be crossed out. Accounting documents that contain erasures or adjustments are invalid. Erroneous accounting documents shall be crossed out.

- Each accounting document must have adequate copies. In case multiple copies are required for a single economic-financial operation, their contents must be identical.

- Accounting documents shall bare adequate signatures and positions of the signers. Indelible ink must be used for signatures on accounting documents. Do not use red ink or signature stamps on accounting documents. A person’s signatures on accounting documents must be consistent. The persons who prepare, approve and sign accounting documents are responsible for contents thereof.

- Accountants of an enterprise that does not have a chief accountant shall make transactions with customers and banks, etc. The chief accountant’s signature shall be received by signatures of such accountants. The accountants shall perform the chief accountant’s rights and obligations.

- Accounting documents shall be signed by authorized persons. An authorized person must not sign an accounting document before it is completed.

- The General Director (Director) or legal representative of the enterprise shall decide the persons authorized to sign accounting documents in accordance with law and suitable for asset control and protection.

- Payment vouchers must be signed by the authorized person or the chief accountant before paying. Every copy of a payment voucher must be signed.

- The chief accountant (or authorized person) must not sign accounting documents on behalf of the head of the enterprise. The authorized person must not authorize another person to sign accounting documents.

- Electronic documents shall bear electronic signatures. Signatures on electronic documents are as valid as those on physical documents.

Can small and medium enterprises design their own accounting documents?

Pursuant to Clause 2, Article 84 of Circular No. 133/2016/TT-BTC stipulating as follows:

General provisions

1. Accounting documents used by enterprises must comply with provisions of the Law on Accounting, its elaborating Decrees and amendments thereto.

2. All templates of accounting documents in Appendix 3 enclosed herewith are instructional. Enterprises may design their own accounting documents to satisfy their needs as long as they are conformable with the Law on Accounting, clear, transparent, easy to inspect and compare.

3. Enterprises that do not design their own accounting document may apply the templates in Appendix 3 enclosed herewith.

4. Enterprises having special financing activities that are regulated by other legislative documents shall apply their provisions.

Thus, small and medium enterprises may design their own accounting documents to satisfy their needs as long as they are conformable with the 2015 Law on Accounting, clear, transparent, easy to inspect and compare.

LawNet