What are guidelines for asset declaration in Vietnam under Appendix 1 of Decree No. 130 in 2024? Do officials pay personal income tax?

What are guidelines for declaring assets under the Appendix 1 of Decree No. 130 in 2024?

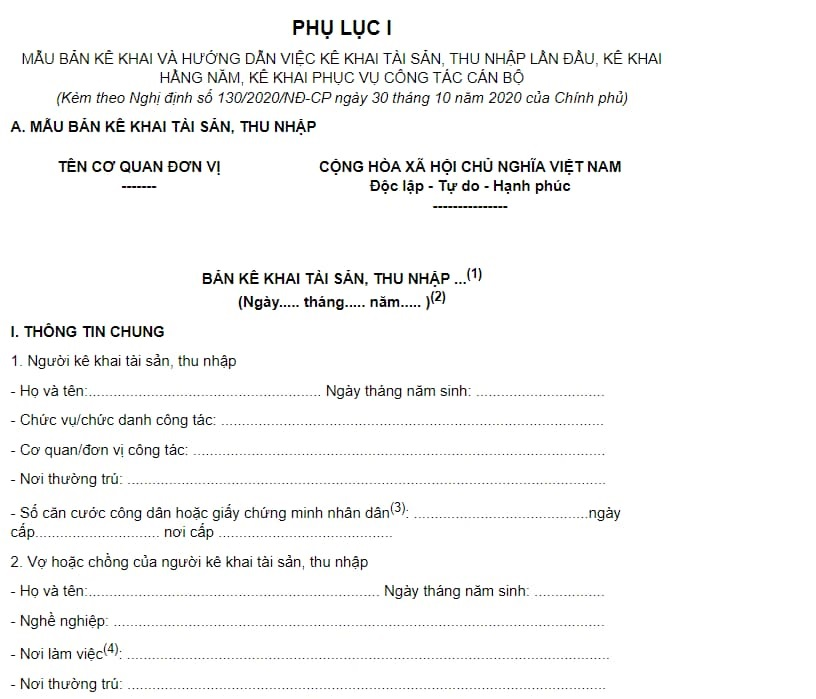

The asset declaration form under Decree No. 130 Appendix 1 is used for the initial income and asset declaration, annual declaration, and declarations for personnel work.

The asset declaration form under Decree No. 130 Appendix 1 is structured as follows:

Download the asset declaration form under Decree No. 130 Appendix 1.

Below are detailed instructions on how to declare assets according to the template in Appendix I of Decree No. 130/2020/ND-CP for the year 2024:

I. GENERAL NOTES

(1) An individual with an obligation to declare assets and income must specify the method of declaration as regulated in Article 36 of the Anti-Corruption Law 2018 (initial declaration or annual declaration, declaration for personnel work).

In the initial declaration, Section III "Changes in assets and income; Explanation of the original source of increased assets and income" is not required.

Note: The declarant must sign each page and sign, clearly stating their full name on the final page of the declaration form. The declarant must prepare two copies of the declaration to be submitted to their managing agency, organization, or unit (one copy for the Agency for Asset and Income Control, and one copy for the management activities of the agency, organization, or unit and for publicizing the declaration). The individual from the managing agency, organization, or unit receiving the declaration must check the completeness of the declared contents and then sign and clearly state their name, date, month, year of receiving the declaration.

(2) State the date the declaration was completed.

II. GENERAL INFORMATION

(3) Record the citizen identification number/ID card. If a citizen ID card is not issued, record the national/ military/police ID number and clearly state the date of issuance and place of issuance.

(4) If the declarant's spouse works regularly in an agency, organization, or business, clearly state the name of that agency/organization/business; if self-employed, retired, or a homemaker, specify accordingly.

III. DESCRIPTION OF ASSET INFORMATION

(5) Assets to be declared are those currently owned or used by the declarant, their spouse, and biological or adopted children (if any) who are minors according to legal regulations.

(6) Actual land use right refers to the declarant's actual right to use specific parcels, including land with or without a land use right certificate.

(7) Residential land is used for living purposes according to land law. If a parcel serves multiple purposes, including residential land, declare it under residential land.

(8) Specify house number (if any), alley, lane, street, village, hamlet, commune, ward, commune-level town; district, district-level town, city under provincial authority; province, centrally run city.

(9) State the land area (m2) according to the land use right certificate or actual measured area (if no certificate is issued).

(10) Value in original cost in Vietnamese currency: For purchased or transferred assets, record the actual payment made, including taxes and fees (if applicable); if self-built, agriculturally renovated, or improved, note the total expenses paid to complete the construction or agricultural improvement, plus any fees; for gifts, donations, or inheritances, record according to market price at the time of acquisition, adding any taxes and fees payable, noting "estimated value"; if unable to estimate due to prolonged or comparative lack of transactions, state "unable to determine value" and the reasons.

(11) If a land use right certificate is issued, state the certificate number and name of the grantee or representative (if a co-ownership certificate); if not issued, state "not issued a land use right certificate."

(12) Specify actual management and use status (e.g., the declarant is the registered owner but it belongs to someone else); transfer and usage conditions such as leasing or borrowing.

(13) Declare land types with usage purposes not residential according to land law.

(14) Record "apartment" if in a collective or shared building; "detached house" if built on an individual parcel.

(15) Record the total floor area (m2) of a detached house, including underground, semi-underground, technical, attic, and rooftop floors. For apartments, state the area according to ownership certificates or purchase/lease contracts.

(16) Other construction works refer to non-residential buildings.

(17) Declare immovable property with an estimated total value from 50 million VND or more for each item.

(18) Perennial plants grown once and harvested for years include industrial crops, fruit trees, timber trees, ornamental or shade trees, excluding production forests.

(19) Production forest refers to planted forests.

(20) Record types of gold, diamonds, platinum and other precious metals, and gemstones with total values from 50 million VND or more.

(21) Money (Vietnamese currency, foreign currency) includes cash, loans, advances, savings in domestic or foreign organizations in Vietnam with total values from 50 million VND or more. For foreign currency, record the quantity and convert to VND.

(22) State each form of direct and indirect business investment capital contribution.

(23) Other valued documents such as fund certificates, promissory notes, checks, etc.

(24) Automobiles, motorcycles, scooters, motorbikes (bulldozers, excavators, other motorized vehicles), ships, aircraft, boats, and other registrable assets valued at 50 million VND or more for each type.

(25) Other assets such as plants, furniture, paintings, and other assets with conversion values of 50 million VND or more for each.

(26) Declare foreign assets with the same categories from items 1 to 7 of Part II and specify the country of residence.

(27) Declare overseas bank accounts; other foreign accounts not being bank accounts but capable of monetary transactions, assets (such as accounts in overseas securities companies, foreign gold exchanges, overseas e-wallets).

(28) Separately declare the total income of the declarant, their spouse, or minor children. In the event of common income that cannot be separated, enter the total common income under common income; foreign currency income converts to VND (including salary, allowances, subsidies, bonuses, fees, gifts, inheritances, sales revenue, investment benefits, innovation, invention, and other incomes). For the first declaration, total income between two declarations is not required. For subsequent declarations, calculate from the previous declaration date up to the day before the new declaration.

IV. CHANGES IN ASSETS, INCOME; EXPLANATION OF THE SOURCE OF INCREASED ASSETS, INCOME

(29) Declare asset increase or decrease at the time of declaration compared to previously declared assets and explain the source of increased assets or income formed during the period starting from the second declaration. If no changes, write “No changes” immediately after the title of Section III.

(30) If assets increase, note a plus sign (+) and the asset quantity increase in the “asset quantity” column, record the increased asset value in the "asset value, income" column, and explain the reason in the column “content explanation of the source of increased assets and total income.”

(31) If assets decrease, mark a minus sign (-) in the “asset quantity” column, note the decreased asset value in the "asset value, income" column, and explain the reason in the column “Content explanation of the source of increased assets and total income.”

(32) State the total income between two declarations in the “asset value, income” column and specify each income obtained during the declaration period.

This information is for reference purposes only.

What are guidelines for asset declaration in Vietnam under Appendix 1 of Decree No. 130 in 2024? Do officials pay personal income tax? (Image from the Internet)

Do officials pay personal income tax in Vietnam?

According to Clause 1, Article 2 of the Law on Personal Income Tax 2007, the subjects required to pay personal income tax are regulated as follows:

Taxpayers

- Taxpayers include resident individuals earning taxable income prescribed in Article 3 of this Law, arising both within and outside Vietnam, and non-resident individuals earning taxable income prescribed in Article 3 of this Law within Vietnam.

...

Thus, according to the above regulations, officials are required to pay personal income tax if they have taxable income arising both within and outside the territory of Vietnam.

What incomes from salary and wage of officials are taxable in Vietnam?

According to Article 19 of the Law on Personal Income Tax 2007 (amended by Clause 4, Article 1 of the Law on Amendments to the Law on Personal Income Tax 2012 and by Article 1 of Resolution 954/2020/UBTVQH14, with content annulled by Clause 4, Article 6 of the Law Amending Various Tax Laws 2014), stipulates:

Family deductions

- Family deduction is the amount deducted from taxable income before calculating tax on income from salaries and wages for resident taxpayers. Family deduction includes the following two parts:

a. The deduction for taxpayer is 11 million VND/month (132 million VND/year);

b. The deduction for each dependent is 4.4 million VND/month.

In the event the consumer price index (CPI) fluctuates over 20% compared to the effective date of the Law or the closest family deduction adjustment, the Government of Vietnam presents the National Assembly Standing Committee with an adjusted family deduction level appropriate for price changes applicable in the following tax period.

- Determining dependent-based family deductions follows each dependent's principle, only accounted once for a taxpayer.

...

Officials with a total income from salaries and wages over 11 million VND/month (132 million VND/year) after deducting insurance contributions, voluntary retirement funds, charitable donations, educational encouragement, humanitarian contributions, tax-exempt income, and non-taxable income items, without dependents, must pay personal income tax.

- Are hazardous allowances subject to personal income tax in Vietnam?

- Shall the TIN be deactivated due to bankrupcy in Vietnam?

- What are guideline for paying the registration fees through VCB bank app? When is the time of payment for registration fees in Vietnam?

- Vietnam: Is tax liability imposed when failing to present accounting books?

- What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)?

- Where to download the latest form 04/HGDL for delivery notes for goods sent to sales agents in Vietnam?

- What is the guidance on first-time taxpayer registration for foreign subcontractors who directly declare and pay contractor tax in Vietnam?

- What are cases where a 10% PIT is withheld in Vietnam?

- How to submit the dependant registration application for persons with income from wages and salaries in Vietnam?

- What are guidelines for first-time taxpayer registration for dependants declared directly at the tax authority in Vietnam?