Vietnam: Things to know about government debt instruments

On June 30, 2018, the Government of Vietnam issued Decree No. 95/2018/ND-CP providing for issuance, registration, listing and trading of government debt instruments on the securities market.

Decree No. 95/2018/ND-CP of Vietnam’s Government specifies government debt instruments as follows:

Issuer of government debt instruments

- Issuer of government debt instruments is the Ministry of Finance.

- With regard to government debt instruments issued in domestic market, the Ministry of Finance shall directly organize the issuance or authorize the State Treasury to organize the issuance and fulfill the issuer’s obligations as prescribed in this Decree.

- Purposes of issuance of government debt instruments include:

+ Government debt instruments are issued in the domestic market to serve the purposes specified in Clause 1, Clause 2 and Clause 3 Article 25 of the Law on Public Debt Management of Vietnam.

+ The purposes of international bonds are set forth in Clause 1 Article 28 of the Law on Public Debt Management.

Buyers of government debt instruments

- The following entities are entitled to buy government debt instruments issued in the domestic market:

+ Domestic and foreign organizations and individuals are allowed to purchase government debt instruments with unlimited quantity, unless otherwise prescribed by law;

+ Securities investment funds and voluntary pension funds are allowed to entrust the purchase of government debt instruments to fund management companies;

+ Off-budget financial funds are allowed to purchase government debt instruments in accordance with applicable relevant laws.

- Buyers of government debt instruments issued on the international market are organizations and individuals authorized by laws applicable in the issuing market.

Rights and obligations of holders of government debt instruments

- A holder of government debt instruments is entitled to:

+ receive full payment of principal and interest on debt instruments upon their maturity date.

+ transfer, give, donate, discount or pledge debt instruments, leave them as inheritance or use them to conduct other transactions in accordance with applicable laws.

- A holder of government debt instruments is obliged to pay tax on his/her income derived from such government debt instruments in accordance with applicable laws on taxation.

Payment of principal and interest

- The Government shall provide funds for paying principal and interest on government debt instruments when they are due in accordance with regulations of the Law on state budget and the Law on Public Debt Management.

- The Ministry of Finance shall take charge of paying principal and interest on government debt instruments issued in the domestic market to holders when they are due.

- The Ministry of Finance shall transfer money to accounts of authorized settlement agencies to pay principal and interest on international bonds to holders upon their maturity date.

- Using funds from issuance of government debt instruments:

+ Total proceeds from each issue of government debt instruments in the domestic market shall be transferred to the central-government budget in accordance with regulations of the Law on state budget, the Law on Public Debt Management and relevant laws.

+ Total proceeds from each issue of international bonds shall be used for the purposes defined in Clause 1 Article 28 of the Law on Public Debt Management and the purposes of issued international bonds as approved by the Government under regulations of Clause 1 Article 31 of Decree No. 95/2018/ND-CP.

Expenses associated with issuance, registration, depositing, payment, repurchase and swap of government debt instruments

- Expenses incurred during the issuance, registration, depositing, payment, repurchase and swap of government debt instruments, and relevant expenses shall be covered by the central-government budget.

- Payments to organizations conducting bidding, underwriting, private placement, registration, depositing, settlement, repurchase or swap of government debt instruments in the domestic market shall be made according to guidance of the Minister of Finance.

- Expenses associated with the issuance and trading of international bonds shall be covered by the central-government budget under specific agreement or contracts signed with partners involved in the bond issuance, and according to notifications of relevant service providers.

Decree No. 95/2018/ND-CP of Vietnam’s Government takes effect from July 01, 2018.

-Thao Uyen-

- Key word:

- Decree No. 95/2018/ND-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam’s regulations on market makers

- 11:31, 11/10/2018

-

- Vietnam: Things to know about issuance of international ...

- 15:38, 06/10/2018

-

- Vietnam’s regulations on government bonds

- 19:05, 12/09/2018

-

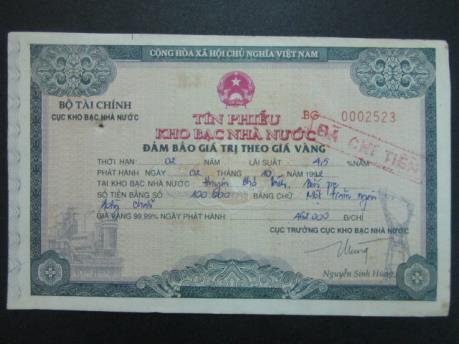

- Vietnam: Things to know about treasury bills

- 10:41, 08/09/2018

-

- Vietnam: A market maker shall be given priority ...

- 08:55, 09/07/2018

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents