Vietnam: Settlement of the case where the land user entitled to defer land levy payment before July 01, 2014 fails to pay the outstanding land levy

This is a content specified in Circular No. 10/2018/TT-BTC issued on January 30, 2018 by the Ministry of Finance of Vietnam, which provides amendments and supplements to Circular No. 76/2014/TT-BTC providing guidance on the Government’s Decree No. 45/2014/NĐ-CP on land levy.

According to Circular No. 10/2018/TT-BTC of the Ministry of Finance of Vietnam, if the land user entitled to defer land levy payment before July 01, 2014 fails to pay the outstanding land levy:

- If the land user deferred the land levy payment before March 01, 2011, within a period of 5 years from March 01, 2011, the land user shall be entitled to pay the outstanding land levies according to the land price applicable at the time when the certificate proving his/her entitlement to use the land is granted; after the period of 5 years, if the land user fails to fully pay the outstanding land levies, the remaining amount of land levies payable shall be determined according to the policies and land prices applicable at the payment date.

- If the land user deferred the land levy payment between March 01, 2011 and July 01, 2014, regulations on payment of outstanding land levies in the Decree No. 45/2014/ND-CP shall apply. The land user shall repay the outstanding land levies within the period of 5 years from the date on which the deferral is recorded; after 5 years from the date on which the deferral is recorded, if the land user fails to fully repay the outstanding land levies, the land user shall repay the remaining amount according to the policies and land prices applicable at the time of repayment.

View more details at Circular No. 10/2018/TT-BTC of the Ministry of Finance of Vietnam, effective from March 20, 2018.

-Thao Uyen-

- Key word:

- Circular No. 10/2018/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Determination of land levies upon the ...

- 10:59, 24/02/2018

-

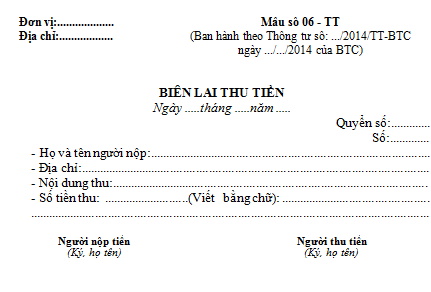

- Vietnam: Documentary evidence for payment of land ...

- 11:08, 17/02/2018

-

- Procedures for reduction in or exemption from ...

- 11:12, 15/02/2018

-

- Vietnam: Determination of land levies on the piece ...

- 10:51, 18/01/2018

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents