Vietnam’s regulations on government bonds

On June 30, 2018, the Government of Vietnam issued Decree No. 95/2018/ND-CP providing for issuance, registration, listing and trading of government debt instruments on the securities market.

Decree No. 95/2018/ND-CP of Vietnam’s Government regulates several important issues regarding government bonds. To be specific:

Issuance of government bonds through bidding

Bidding is a method of offering government bonds whereby potential investors bid on the government bonds by offering their interest rates.

Bidding principles:

- A bidder’s bid information must be kept secret.

- Bidders shall have their rights and obligations ensured openly and impartially.

Bidders:

- Market makers as defined in Section 4 Chapter II of herein.

- Other entities that are defined in Clause 1 Article 6 herein and purchase government debt instruments through bidding via market makers.

Bidding forms: Bidding for government bonds is conducted in either of the following forms:

- Competitive bid; or

- Combination of competitive bid and non-competitive bid. If a bid session is conducted in this form, the total amount of bonds offered to non-competitive bidders shall not exceed 30% of total amount of bonds offered in that bid session.

Bidding results shall be determined by adopting either the fixed-rate tender method or the variable-rate tender method. Based on the market developments, the Ministry of Finance shall decide adoption of the fixed-rate tender method or the variable-rate tender method in each period.

The issuer shall directly organize bidding for government bonds or organize bidding via the Stock Exchange in accordance with regulations of the Ministry of Finance.

Issuance of government bonds through underwriting

Underwriting is a method of offering government bonds through an underwriter syndicate, which is comprised of:

- A lead underwriter and/or co-lead underwriters; and

- Syndicate participant(s).

Eligibility requirements to be satisfied by a lead underwriter:

- It must be a financial institution that is duly established and operating in Vietnam, and licensed to provide securities underwriting as regulated by laws.

- It must have experience in providing securities underwriting;

- It must have a feasible underwriting plan which meets the needs of the issuer in each issue.

Process of issuing bonds through underwriting:

- Based on underwriting requirements for each bond issue and requirements applicable to lead underwriters as prescribed, the State Treasury shall select qualified organization(s) to act as the lead underwriter or co-lead underwriters for a bond issue. The lead underwriter (or co-lead underwriters) shall select qualified entities to participate in the underwriting syndicate, and submit the list of selected syndicate participants to the State Treasury for consideration.

- The State Treasury shall provide necessary information concerning the bond issue for the lead underwriter (or co-lead underwriters) and the syndicate participants who will take charge of seeking potential investors. Information to be provided includes:

+ Planned quantity of bonds to be issued;

+ Planned term of bonds to be issued;

+ Interest rate for each bond term;

+ Issuance date.

- The lead underwriter (or co-lead underwriters) and the syndicate participants shall prepare a consolidated report on the needs of investors, including the planned quantity of bonds to be purchased, the quantity of bonds firmly purchased and expected interest rate for each bond term, and then submit it to the State Treasury.

- The State Treasury shall carry out a negotiation with the lead underwriter (or co-lead underwriters) on the quantity, terms and conditions of bonds (including bond term, interest rate, date of issuance, date of bond settlement, and bond prices), underwriting fee and relevant contents.

- Based on results of the negotiation with the lead underwriter (or co-lead underwriters), the State Treasury shall enter into an underwriting agreement with the lead underwriter (or co-lead underwriters) for offering of bonds. The signed underwriting agreement shall be the legal ground for determining rights and obligations of the lead underwriter (or co-lead underwriters) and those of the State Treasury.

- The lead underwriter (or co-lead underwriters) and syndicate participants shall sell bonds as committed in the signed underwriting agreement. In case of failure to sell all of bonds of an issue, the lead underwriter (or co-lead underwriters) and syndicate participants shall purchase the remaining quantity of bonds.

-Upon the end of an underwritten bond issue, the State Treasury shall offer government bonds to investors whose names appear in the list of bond buyers submitted by the lead underwriter (or co-lead underwriters).

Trading of government bonds

Government bonds shall be traded on the securities market by order-matching method and/or put-through (negotiated trading) method in accordance with the Law on securities and the Stock Exchange’s regulations approved by a competent authority.

Government bonds shall be traded on the securities market in the following forms:

- Outright;

- Repo and sell/buy back;

- Other trading forms as prescribed by the Law on securities.

In particular, repo and sell/buy back transactions of government bonds set forth above are conducted by applying the following principles:

- Term of a repo or sell/buy back transaction shall not exceed 01 year;

- The buyer and seller shall themselves carry out a negotiation and enter into a repurchase agreement or sell and buy back agreement, which includes the following contents: quantity; interest rate (or bond price); term; collateral; hedge ratio; rights and obligations of contractual parties; disposal of collateral in case of either party’s failure to make the previously agreed settlement.

The SBV shall provide guidance on classification of debts and credit risk provisions for credit institutions that enter into repos and sell/buy back transactions of government bonds on the securities market.

Decree No. 95/2018/ND-CP of Vietnam’s Government takes effect from July 01, 2018.

-Thao Uyen-

- Key word:

- Decree No. 95/2018/ND-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam’s regulations on market makers

- 11:31, 11/10/2018

-

- Vietnam: Things to know about issuance of international ...

- 15:38, 06/10/2018

-

.jpg)

- Vietnam: Things to know about government debt ...

- 10:25, 13/09/2018

-

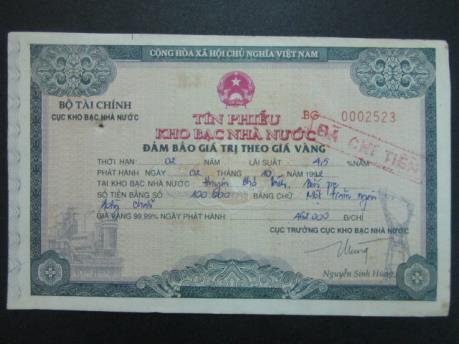

- Vietnam: Things to know about treasury bills

- 10:41, 08/09/2018

-

- Vietnam: A market maker shall be given priority ...

- 08:55, 09/07/2018

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents