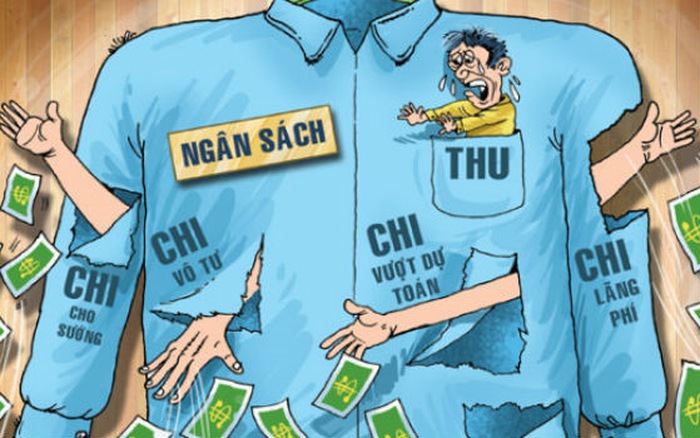

Vietnam: Request for assignment of 2012 investment and development expenditure estimates

Recently, the Ministry of Finance of Vietnam has issued Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012.

According to Article 3 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, Ministries, central and local agencies allocating and assigning development investment expenditure estimates must strictly comply with the provisions of the law on state budget and the law on investment and construction management; concurrently ensure the following requirements:

- Ministries and central agencies: allocate capital and assign capital construction investment cost estimates to ensure compliance with Directive No. 1792/CT-TTg dated October 15, 2011 of the Prime Minister on strengthening investment management from state budget capital and government bond capital.

- Provinces and central-affiliated cities: in addition to allocating capital and assigning capital construction investment cost estimates ensuring compliance with Directive No. 1792/CT-TTg dated October 15, 2011 of the Prime Minister on strengthening investment management from state budget capital and government bond capital, the following contents should be noted:

+ Allocate capital to recover the advance due in 2012 under the Prime Minister's decision; arrange to pay in full (both principal and interest) the mobilized investment amounts as prescribed in Clause 3, Article 8 of the Law on State Budget which are due in 2012; pay preferential credit loans for the implementation of the program to solidify canals, rural transport, craft village infrastructure, and fisheries infrastructure that are due in 2012.

+ Ensure adequate allocation of capital from the local budget for projects and programs partially supported by the central budget to realize project and program objectives.

+ For locally-managed ODA projects: Focus on allocating adequate reciprocal capital from the local budget for projects as committed.

+ Allocate and assign development investment expenditure estimates to subordinate agencies, units and administrations in the fields of education - training and vocational training, science and technology fields must not be lower than the Prime Minister assigned to these areas.

+ In case there is a need to mobilize capital to invest in the construction of socio-economic infrastructure works guaranteed by the provincial budget, in the list of investment in the 5-year plan (2011 - 2015) approved by the provincial-level People's Councils, it is is allowed to mobilize capital domestically, ensuring the maximum mobilized loan balance does not exceed 30% of the domestic capital construction investment capital in 2012 of the provincial budget in accordance with the provisions of the State Budget Law and other documents. Particularly for Hanoi and Ho Chi Minh City, the capital mobilization level shall comply with the provisions of Decree No. 123/2004/ND-CP dated May 18, 2004 and Decree No. 124/2004/ND-CP dated May 18, 2004 of Vietnam’s Government.

In addition, for localities that need to advance capital for the implementation of projects or infrastructure investment works, generating revenue to repay the advance capital approved by competent authorities to attract investment capital of domestic and foreign economic organizations, shall comply with the provisions of Circular No. 49/2005/TT-BTC dated June 9, 2005 of the Ministry of Finance.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents