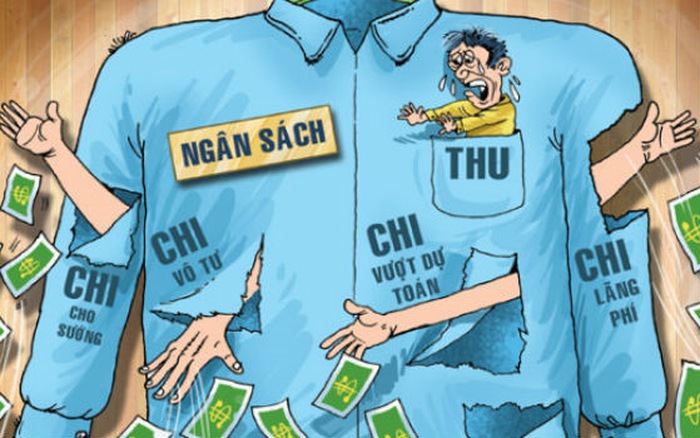

Vietnam: Provincial People's Committees save 10% of recurrent expenses in 2012

On December 06, 2011, the Ministry of Finance of Vietnam issued the Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012.

According to Article 4 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, Ministries and central agencies when allocating and assigning budget estimates to their attached units; People's Committees of the provinces and central-affiliated cities, when allocating and assigning budget estimates to the lower-level budgets, must determine to save 10% of recurrent expenditures in 2012 (excluding salaries, salary calculated according to the minimum salary of 830,000 VND/month) which must not be lower than the level guided by the Ministry of Finance; People's Committees at local levels, when allocating and assigning estimates to their affiliated units, do not include 10% of recurrent expenditure savings in 2012 (excluding public non-business units implementing the financial mechanism as prescribed in Decree No. 43/2006/ND-CP dated April 25, 2006, Decree No. 115/2005/NĐ-CP dated September 05, 2005, Decree No. 96/2010/NĐ-CP dated September 20, 2010 of Vietnam’s Government and State agencies implementing the mechanism of autonomy and self-responsibility for the use of payroll and administrative management funds according to the provisions of Decree No. 130/2005/NĐ-CP of Vietnam’s Government), to implement the salary reform regime in 2012.

Concurrently, Ministries and central agencies guide their affiliated units to spend 40% of the proceeds left under the 2012 regime (particularly for the health sector is 35%, after deducting costs of drugs, blood, infusion fluids, chemicals, substitutes and consumable) to implement the wage reform regime in 2012; in which, note some of the following revenues:

- For tuition fees for regular students attending public schools: 40% of the revenue for the implementation of the salary reform regime is calculated on the entire tuition fee collection of students.

- For tuition fees from in-service training activities, joint ventures and other training activities of public schools: 40% of the revenue for implementing wage reform is calculated on the full tuition revenue from the above activities after excluding related costs.

- For revenues from services, joint venture activities and other revenues of non-business units (besides the revenue according to the Ordinance on Fees and Charges): 40% of the revenue for implementing wage reform is calculated on the total revenue of the above activities after deducting related expenses.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents