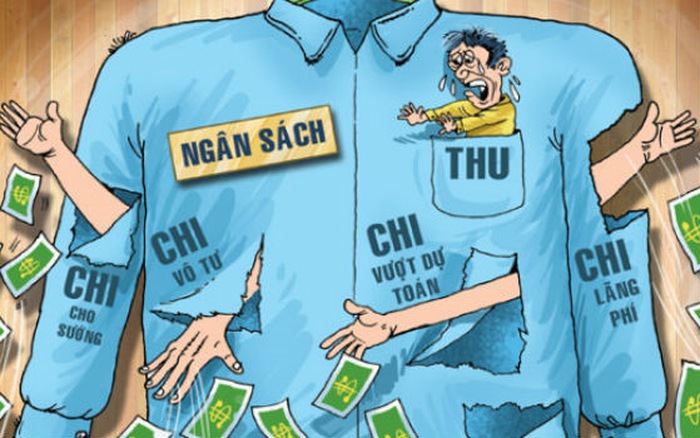

Vietnam: Provincial People's Committee submits decision on budget revenue and expenditure estimates before December 10, 2011

Recently, the Ministry of Finance of Vietnam has issued Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012.

According to Article 5 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, provincial-level People's Committees, based on the Prime Minister's decisions on assignment of budget revenue and expenditure tasks, shall submit to the People's Councils of the same level for decision estimates of local budget revenues and expenditures, the provincial budget allocation plan and the additional level from the provincial budget to the subordinate budget before December 10, 2011. The district-level People's Committees shall base themselves on the provincial-level People's Committees' decisions on assigning budget revenue and expenditure tasks to submit them to the People's Councils of the same level for decision on estimates of district budget revenues and expenditures before December 20, 2011. The commune-level People's Committees shall base themselves on the district-level People's Committees' decisions on assigning budget revenue and expenditure tasks and submit them to the People's Councils of the same level for decision on budget revenue and expenditure estimates and the plan for allocation of commune budget estimates before December 31, 2011 and allocate recurrent expenditure estimates according to each type and section of the State Budget Index issued under Decision No. 33/2008/QD-BTC dated June 02, 2008 of the Minister of Finance and documents of the Ministry of Finance amending and supplementing this Decision; and send it to the State Treasury where the transaction is located (one copy) as a basis for payment and expenditure control.

Based on budget revenue and expenditure estimates assigned by competent authorities, ministries and central agencies (for the central budget) decide to allocate and assign budget estimates to each budget-using unit; People's Committees at all levels (for local budgets) shall submit to the People's Councils of the same level for decision estimates of state budget revenues in the locality, local budget expenditure estimates, decide on the allocation of budget estimates at their own level, ensuring that the 2012 budget revenue and expenditure estimates are delivered to each budget-using unit before December 31, 2011 and organize the publicization of budget estimates in accordance with the Law on State Budget.

Provincial-level People's Committees are responsible for reporting on the results of allocation and assignment of local budget estimates to the Ministry of Finance within 5 days after the People's Councils of the same level decide on budget estimates in accordance with Article 40 of the Decree No. 60/2003/ND-CP dated June 06, 2003 of Vietnam’s Government detailing and guiding the implementation of the State Budget Law àn Point 5.3 Section 5 Part III of Circular No. 59/2003/TT-BTC dated June 23, 2003 of the Ministry of Finance of Vietnam; report the level of capital mobilization in 2012 according to Clause 3, Article 8 of the Law on State Budget, the outstanding balance of mobilized capital from the local budget as of December 31, 2011 to the Ministry of Finance before January 31, 2012; report on revenue, expenditure and balance of the Financial Reserve Fund as prescribed at Point 19.3 Section 19 Part IV of Circular No. 59/2003/TT-BTC dated June 23, 2003 of the Ministry of Finance of Vietnam.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents