Vietnam: Determination of land levies on the piece of land whose purposes permitted to be changed paid by the economic organization

On January 30, 2018, the Ministry of Finance of Vietnam issued Circular No. 10/2018/TT-BTC, which specifies the determination of land levies on the piece of land whose purposes permitted to be changed paid by the economic organization.

According to Circular No. 10/2018/TT-BTC of the Ministry of Finance of Vietnam, land levies shall be determined as follows:

- The remaining land use period shall be expressed in months if it is shorter than a full year, and considered as 01 month if it is shorter than a month but not shorter than 15 days. Land levy shall not be imposed for the remaining land use period which is shorter than 15 days.

- If the purpose of the piece of land which is transferred from the household or individual is changed from the non-agricultural land (other than the residential land) to the land for construction of an investment project from July 01, 2014 onwards, the land levy to be paid shall be the difference between the land levy calculated according to the detailed construction plan for the project given approval by the competent authority and the land levy calculated according to the household or individual’s housing construction plan of each region on the date on which the permission for changes in purposes of the piece of land is made by the competent authority.

- If an economic organization is allowed to change the purpose of the piece of land, which is allocated with payment of land levies, in accordance with regulations in Clause 29 and Clause 30 Article 2 of Decree No. 01/2017/NĐ-CP of Vietnam’s Government, it must pay the land levy which is the difference between the land levy calculated according to the price of the piece of land after change over the determined land use term and the land levy calculated according to the price of the piece of land before change over the remaining use term and the date on which the permission for changes in purposes of the piece of land is made by the competent authority.

View more details at Circular No. 10/2018/TT-BTC of the Ministry of Finance of Vietnam, effective from March 20, 2018.

-Thao Uyen-

- Key word:

- Circular No. 10/2018/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Settlement of the case where the land ...

- 11:27, 02/03/2018

-

- Vietnam: Determination of land levies upon the ...

- 10:59, 24/02/2018

-

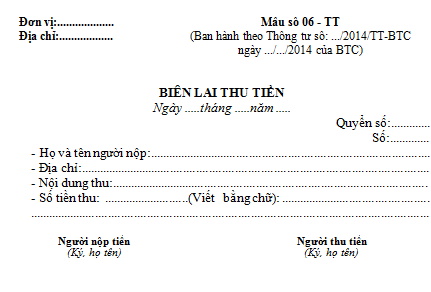

- Vietnam: Documentary evidence for payment of land ...

- 11:08, 17/02/2018

-

- Procedures for reduction in or exemption from ...

- 11:12, 15/02/2018

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents