Vietnam: Assigning cost estimates for socio-economic, defense, security and administrative management in 2012

On December 06, 2011, the Ministry of Finance of Vietnam issued the Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012.

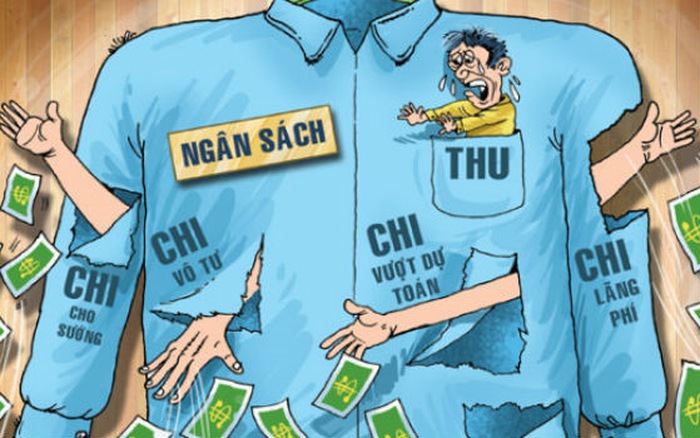

According to Article 3 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, allocating and assigning expenditure estimates for socio-economic, defense, security and administrative management in 2012 are prescribed as follows:

- Ministries, central and local agencies, when allocating and assigning estimates of expenditures on socio-economic, national defense, security and administrative management, shall ensure funding for performing important tasks as prescribed by law, tasks decided by the Government and Prime Minister, and allocating sufficient funds to implement the promulgated policies and regimes. Concurrently ensuring tight, thrifty and efficient budget spending requirements, contributing to the achievement of socio-economic development goals, ensuring sufficient resources to implement social security policies.

- Ministries, central agencies and localities, when allocating and assigning estimates of expenditures on socio-economic, defense, security and administrative management (including salary reform funding with a minimum salary of 830,000 VND/month) to budget-using units, must ensure that exactly match the expenditure estimates assigned by the Prime Minister, guided by the Ministry of Finance, decided by the People's Council, and assigned by the People's Committee in both total and detailed amounts for each expenditure field; allocating expenditure estimates must comply with regulations, standards and norms as prescribed by law.

- In addition, when allocating estimates to non-business units, on the basis of estimates assigned by the Prime Minister, Ministries and central agencies shall decide the appropriate level of funding allocation to non-business units to ensure efficiency on the principle that units with non-business revenue and service fee collection must strive to raise the level of self-financing needs from their own non-business revenue and fee collection, in order to reserve priority sources for units operating mainly with the state budget. Continue to give autonomy to non-business units and implement socialization of all types of non-businesses, especially healthcare and education to a higher level.

+ Allocating and assigning 2012 budget expenditure estimates to subordinate agencies, units and administrations in the fields of education - training and vocational training, the field of science and technology must not be lower than the expenditure estimates assigned by the Prime Minister. When allocating and assigning expenditure estimates in the field of education - training, ensuring funding for performing tasks of all levels of education, in which, attention should be paid to allocating funds to perform the task of universalizing 5-year-old preschool education, funding to support learning expenses and tuition fee exemption and reduction according to Decree No. 49/2010/ND-CP dated May 14, 2010 of Vietnam’s Government. Fully implement the policy on early childhood education development according to the Prime Minister's Decision No. 60/2011/QD-TTg dated October 26, 2011 providing a number of policies on preschool education development during 2011-2015 and Decision No. 149/2006/QĐ-TTg dated June 23, 2006 approving the scheme on preschool education development in the 2006-2015 period.

+ For the field of non-business environmental protection: Provincial-level People's Committees, based on estimates assigned by the Minister of Finance, regimes and policies, volume of tasks to be performed, and based on local realities, shall submit them to the People's Councils of the same level for decision. In which, focusing on allocating funds for medical waste treatment, environmental sanitation in schools, waste treatment yards, procurement of vehicles for waste collection, treatment of hot spots in the environment.

+ Based on the 2012 budget estimate, provinces and central-affiliated cities shall allocate funds to implement the policies and regimes promulgated by the Central Government until the time of handing over the 2012 budget estimate so that policy beneficiaries can receive support money right from the first months of 2012.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents